The Covid-19 crisis has hit the tourism and travel industry hard. In a recent report, the UK’s Institute of Fiscal Studies states: “Tourism and leisure (excluding air travel) stands out in being one of the hardest hit industries.”

While some are quick to predict the end of tourism as we know it thanks to Covid-19, others believe businesses must digitise and adapt their existing business models to save the travel industry.

The good news is, as governments start to withdraw travel restrictions, it appears holiday-goers are regaining confidence in the tourism industry – according to our exclusive research.

New research from Digivante

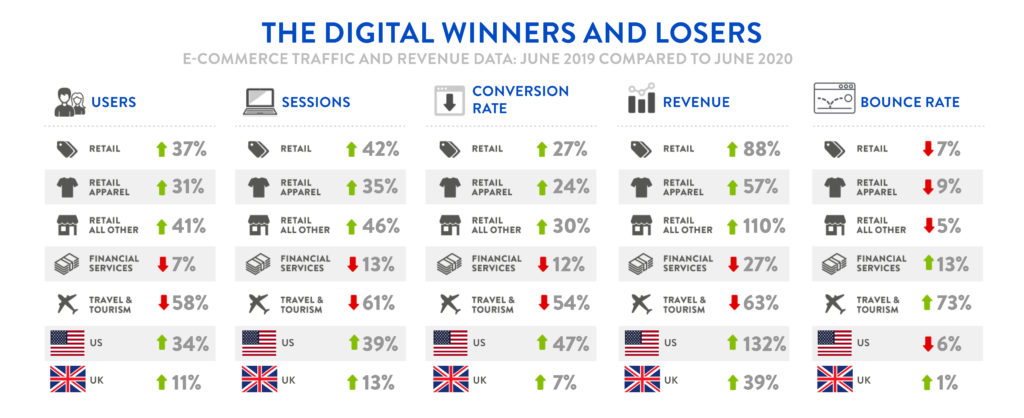

At Digivante, we pulled together digital data from June 2020 and compared it against June 2019 and May 2020. The resulting infographic tracks the effect of coronavirus on specific industries – highlighting that the hard-hit travel and tourism sector is starting to recover.

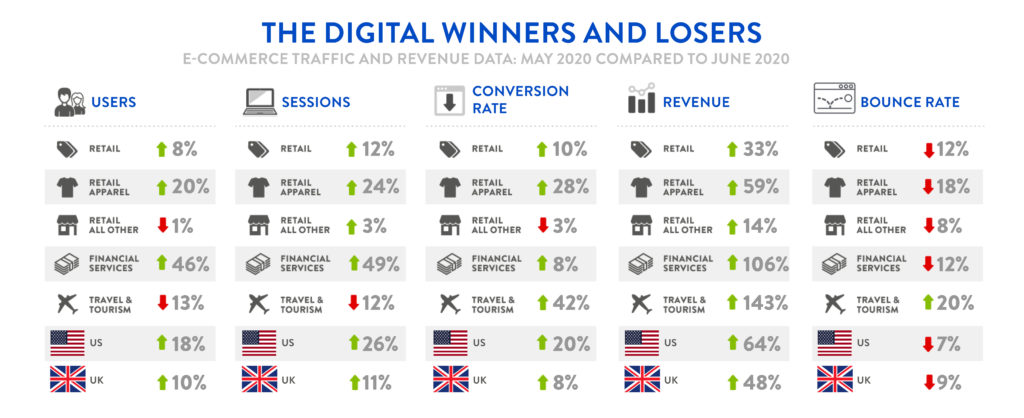

For this piece of research, we collected Google Analytics data from more than 100 retail, travel and financial brands. For May 2020 compared to June 2020:

May 2020 compared to June 2020

*Google Analytics Data on over 100 retail, travel and financial services brands

June 2019 compared to June 2020

*Google Analytics Data on over 100 retail, travel and financial services brands

Travel companies are starting to see a significant increase in demand, as consumers start to gain confidence in the market and travel restrictions ease. The financial services sector is also recovering well, showing signs of recovery in last month’s stats too.

After an initial boom period during lockdown, the retail industry is also stabilising, reporting steady growth in some areas and marginal losses in others.

Removing restrictions

During lockdown, more than 200 countries and territories imposed travel restrictions, including total or partial border closures, suspended flights, and quarantine measures. A recent study found that 82% of travellers also changed their travel plans due to Covid-19.

This had a knock-on effect for the travel industry. The number of commercial flights has plummeted from more than 100,000 in January/February of this year to 78,500 in March and 29,400 in April. What’s more, hotel occupancy rates dropped significantly and the sector is predicted to lose more than 100 million jobs in 2020, according to recent projections.

Now, the industry is starting to recover. Looking at our stats for May and June 2020, some of the major online winners operate in the travel industry. In particular, a major coach operator in the UK has reported a revenue increase of more than 350%, with revenues rising from £100,000+ in May 2020 to £460,000+ in June 2020.

Other online holiday operators have reported similar growth, including tour operators, holiday home providers, and others working in the travel and tourism, and hospitality sectors.

Looking at our stats for June 2020 vs June 2019, the travel industry has realised:

- Users – Increased by 72% since last month

- Sessions – Increased by 84% since last month

- Revenue – Increased by 289% (!!!) since last month

- Conversion Rate – Increased by 86% since last month

- Bounce Rate – Decreased by 28% since last month

Keep on shopping?

As the world continues to open its doors – with non-essential UK shops reopening on 15 June – we have noticed a major downturn for some online stores. In fact, businesses in the retail industry swept the board as the biggest online losers between May and June 2020. One cosmetics brand and another appliances company did not make any revenue in June 2020, for example.

With the retail sector seeing a massive online shopping surge during the early stages of lockdown, such growth was always impossible to maintain, particularly as high street stores reopened. We predicted a dip in these figures in our previous analysis. So, this reduction is not a massive surprise – more a symptom of the world returning to normal.

However, comparing June 2019 and June 2020, many retailers are returning to similar revenue levels that they realised before the Covid-19 crisis.

In fact, some are continuing to increase their revenues – the top four winners when looking at the 2020 versus 2019 figures operate in the retail industry (two in apparel and two in facilities), increasing their revenues by more than 300% in each case.

So, this is a tale of two time zones. If we take Covid-19 out of the picture (looking only at the 2019 stats), the retail sector is continuing to flourish and show year-on-year growth.

If we only look at the May versus June 2020 stats, the retail sector is plummeting but then, thanks to the online retail surge from Covid-19, there was only one direction it could go in the short-term anyway and as things start to return to normal.

A healthy future

Bike retailers fared badly in the May 2020 versus June 2020 figures – with two major brands reporting significant revenue decreases compared to the previous month. One retailer saw revenues drop by 96%, from £4,200,000+ in May 2020 to just £170,000+ in June 2020.

But cycling retailers may see a resurgence in the coming months – the UK Government recently announced doctors should prescribe bike rides to tackle the country’s obesity crisis, launching a ‘fix your bike’ voucher scheme.

That’s not all. The recent Covid crisis may have accelerated a growing wellness trend, with an ‘astonishing’ quit rate amongst young smokers. This trend is present in our analysis too, where one of the biggest online losers is a vaping business, whose revenues have shrunk by 44% in the last month.

An online sneaker retailer also realised the largest proportional revenue increase across all sectors during this month, with revenues increasing from £2,000+ in May 2020 to £35,000+ in June 2020 – that’s a massive 1384% difference.

Uncertainty remains

Going back to the stats for this online sneaker retailer, its massive monthly growth is only part of the picture. This sneaker retailer may have realised revenues of £35,000+ in June 2020 – but it had revenues of almost £2m in June 2019.

However, this is not an anomalous result – other businesses in other industries have reported similar fluctuations – where they appear to be recovering from a very tough few months.

For example, one cruise operator is a big winner when comparing revenues between May and June 2020, with a 350+% rise. But this only represents an increase from £475 to £2,150 in the last month. In June 2019, the same company reported revenues of more than £182,000.

It’s a similar story for many other tour operators, travel insurers and those working in the entertainment industry. The initial signs of recovery are present in the May versus June 2020 figures – but we still have a long way to go to match the pre-Covid revenues of 2019.

We are still living in turbulent times, where the ongoing impact of Covid-19 and the resulting uncertainties for businesses operating in every industry is still prevalent.

The good news is that we are starting to see the initial signs of recovery across some of the worst-hit sectors – especially the travel and tourism sector – as consumers regain their confidence and start to re-enter the world.

To ensure your business is ready for whatever changes happen, Digivante can help you test, analyse and benchmark your performance in these challenging times.