Navigating the world of online sales in the UK can be challenging, especially when it comes to ensuring smooth payment processes. With online shopping being increasingly popular, it’s essential to avoid common payment issues that could drive customers away. Drawing from our extensive experience as a CRO & testing company specialising in ecommerce, collaborating with some of the UK’s leading retailers, let’s delve into common ecommerce payment problems we’ve encountered and strategies to prevent them, ensuring your sales stay on track.

Imagine being ready to buy a product, but the ecommerce payment gateway fails. Frustrating, right? This is a common experience for many shoppers. In fact, around 70% of UK shoppers abandon their carts, often due to payment issues. This isn’t just inconvenient for customers – it represents a significant revenue loss for businesses.

The impact of payment issues on business

Understanding the financial implications of payment issues is crucial. By 2025, the proportion of all UK retail sales made online is predicted to reach £152 billion, highlighting the rapid growth of ecommerce in the retail sector. However, amidst this growth lies a concerning statistic: a staggering 70% cart abandonment rate due to payment hurdles.

This abandonment translates into billions in lost revenue annually. Imagine the potential sales that slip away when customers encounter payment failures or security concerns during checkout. Addressing these issues isn’t just about improving digital customer experience – it’s about safeguarding your bottom line.

Common ecommerce payment issues

Technical errors

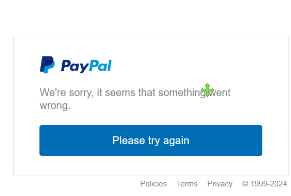

In the fast-paced world of ecommerce, even the smallest functional glitch can lead to significant repercussions. Bugs such as ecommerce payment processing errors, timeout issues, or system crashes during checkout can frustrate customers and prompt them to abandon their purchase.

Having the right ecommerce payment provider for your needs is critical. Some of the most popular are PayPal, Stripe, Shopify Payment, Salesforce, Bluesnap, Square, etc. You still have to interface with these, and every change, either at your end or the provider’s end, can have an adverse impact on your ecommerce platform.

Technical error examples we’ve come across

As a testing company, we frequently encounter various functional issues related to payment integrations. Here are some common technical errors:

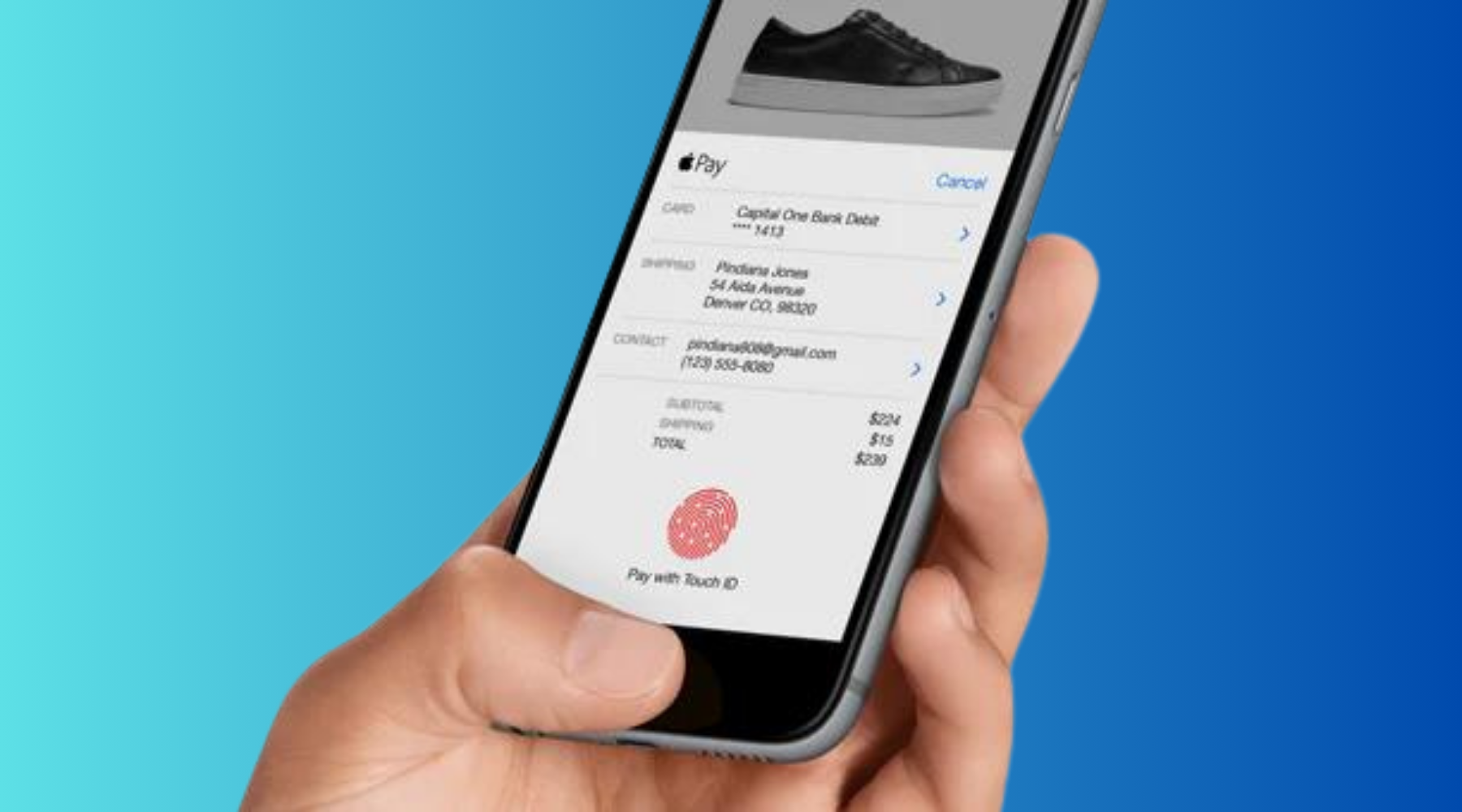

- Inconsistent behaviour when using integrations like Apple Pay, PayPal, or Google Pay for login and payment options.

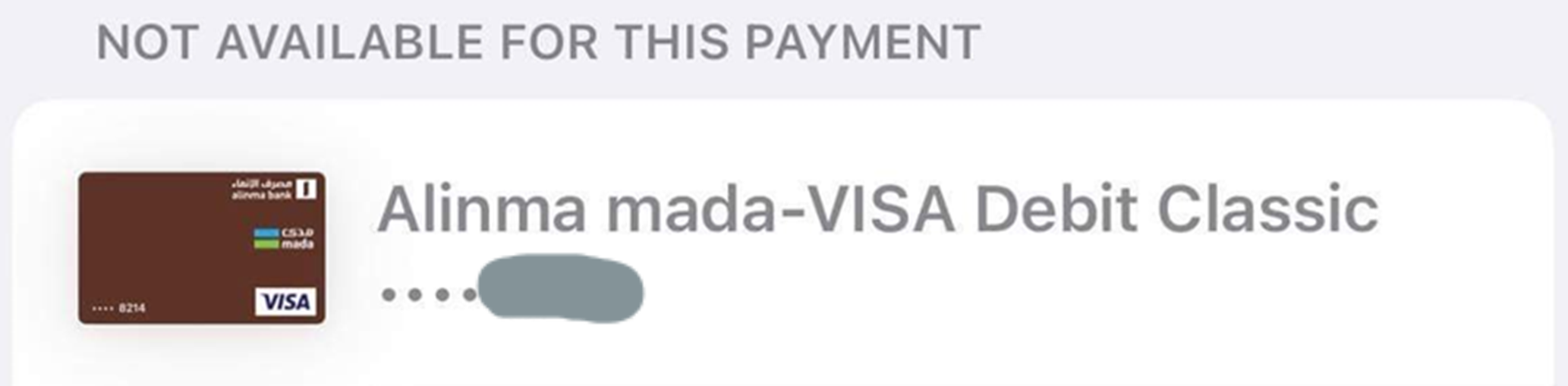

- Cards associated with Apple Pay not being accepted by the website, such as Mada cards used in Saudi Arabia.

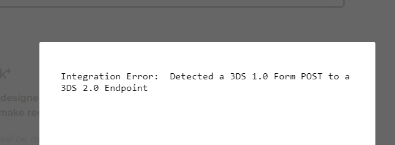

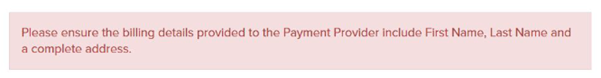

- Integration failures with third-party payment providers.

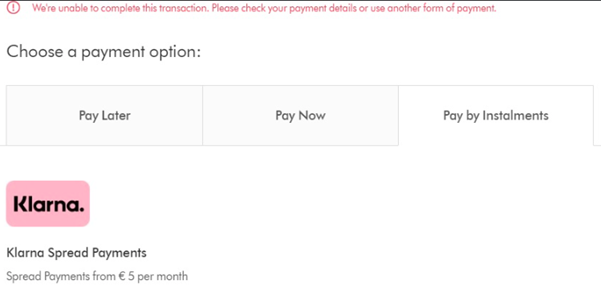

- Errors when using Klarna for instalment payments due to integration issues.

- GPay data for returned addresses not matching the database fields format.

- Payment options not showing on mobile phones with smaller screens

- PayPal integration failures.

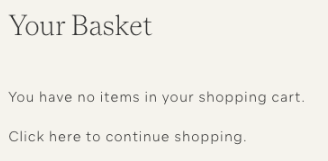

- The shopping basket being cleared when the payment method is changed.

- Payment options available in one browser but not in another.

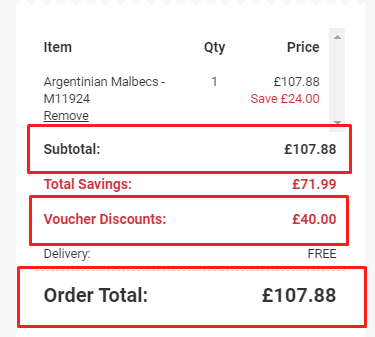

- Vouchers applied and showing savings in the cart but not being applied to the order total.

How to avoid technical errors

- Test integration setups using sandboxes in the test environment. When introducing a new payment method in production, test with end-to-end live order processing.

- In production, regularly check live order processing, and if any drop in conversions occurs, investigate and carry out live orders if needed.

- Regression test conversion journeys every release, including UAT and in production, with live order end-to-end testing.

- Ensure conversion journeys are tested across multiple devices and operating systems. Use Google Analytics or similar tools to find out the devices your customers use and ensure these are prioritised for testing and delivering related fixes.

User Experience (UX) issues

The checkout process is the final gateway between a customer and their purchase. However, a cumbersome and convoluted checkout journey can significantly deter customers from completing their transactions. With 60% of shoppers abandoning their purchases due to poor UX, simplifying the checkout experience is crucial to reducing abandonment rates and enhancing customer satisfaction.

Examples of UX issues we’ve come across

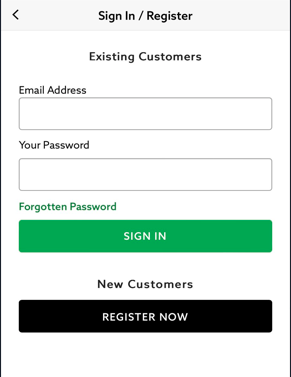

- Not providing third-party integrations such as Apple Pay, PayPal, or Google Pay during the checkout journey, which inconveniences customers by not allowing seamless import of details like name and address.

- Requiring customers to re-enter data already stored by third parties, causing frustration.

- Multiple clicks needed to complete a purchase after using a third-party integration, creating a barrier to conversion.

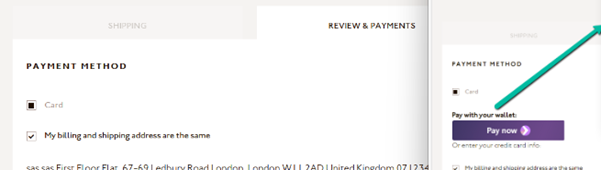

- Express checkout options that don’t feel natural within the checkout flow due to poor placement.

- Content overlapping with an express pay button across different screen sizes and browsers, disrupting the user experience.

How to avoid UX issues

- Make the integrations with third parties as seamless as possible with minimal additional data entry.

- Once a customer confirms the purchase method, complete the order without additional clicks.

- On mobile devices, where abandonment rates are notably higher at around 85.65%, optimising the checkout process for speed and simplicity is paramount. Small improvements in usability can lead to substantial reductions in abandonment rates.

Lack of payment options

Offering a variety of online payment systems for ecommerce is crucial. From credit cards to ecommerce payment providers such as PayPal and even buy-now-pay-later options like Klarna, giving customers choices can reduce cart abandonment. Testing each method ensures they work flawlessly.

Payment gateway integration challenges

Integrating various ecommerce payment gateways can be complex. Each gateway has its own set of APIs, documentation, and quirks. Inconsistent documentation or lack of support can lead to integration delays and errors, impacting the overall user experience.

How to avoid payment gateway integration challenges

- Choose payment gateways with comprehensive and clear documentation.

- Leverage sandbox environments to thoroughly test integrations before going live.

- Regularly update and maintain the integration code to handle changes in the gateway APIs.

Declined transactions and payment failures

Declined transactions are another major issue. Whether due to insufficient funds, incorrect card details, or fraud detection mechanisms, these failures frustrate customers and can lead to lost sales.

How to avoid declined transactions and payment failures

- Provide clear error messages to inform customers why a transaction was declined.

- Offer multiple payment options to give customers alternative methods to complete their purchase.

- Implement robust fraud detection and prevention mechanisms without overly restricting genuine transactions.

Payment security and data breach concerns

UK shoppers are cautious about security. In fact, 72% abandon their carts due to security worries. Regular security updates and rigorous testing can help maintain their trust. Ensure your SSL certificates are always up-to-date and your payment processes are secure.

How to avoid payment security and data breach concerns

- Regularly audit your security protocols and update them as necessary.

- Use encryption and secure connections for all transactions.

- Educate customers about your security measures to build their confidence.

Payment processing delays

Delays in payment processing can cause significant inconvenience and anxiety for customers. Whether due to network issues, technical glitches, or payment gateway problems, delays can deter customers from making future purchases.

How to avoid payment processing delays

- Monitor payment processing times regularly and address any bottlenecks.

- Choose reliable payment gateways known for fast processing times.

- Communicate with customers about any expected delays and provide reassurance.

The key challenges of payment issues identification

Identifying issues in a live environment

Spotting payment issues in real-time presents a significant challenge for online retailers. The complexity of payment transactions, coupled with the diverse payment methods and global customer base, requires vigilant monitoring. Regular testing and monitoring are essential to identifying and resolving problems before they escalate. Leveraging monitoring and performance tools such as New Relic, Datadog, or Splunk as well as utilising rapid testing services such as Digivante’s payment testing service can provide insights into potential issues, ensuring a smooth payment journey for customers.

Handling edge cases

From peak shopping periods like Black Friday to international customers with varying payment preferences, your payment gateway must handle diverse scenarios seamlessly. Testing should include simulations of high-traffic events and international transactions to uncover and address potential bottlenecks or failures. This proactive approach ensures that your system can perform reliably under peak loads and across different devices and operating systems.

Best practices for avoiding payment issues

A comprehensive testing strategy is crucial to ensuring the reliability and functionality of your payment system. You can employ a combination of automated testing for repetitive tasks and manual testing to simulate real-user interactions and edge cases. This dual approach helps in uncovering both common and obscure issues, guaranteeing that your payment system operates flawlessly across various scenarios and devices.

Ready to streamline your ecommerce payment processes and minimise cart abandonment? Discover how Digivante’s comprehensive and rapid payment testing can ensure flawless functionality across all payment methods and scenarios. Contact us today to schedule a consultation and take your online sales to the next level.